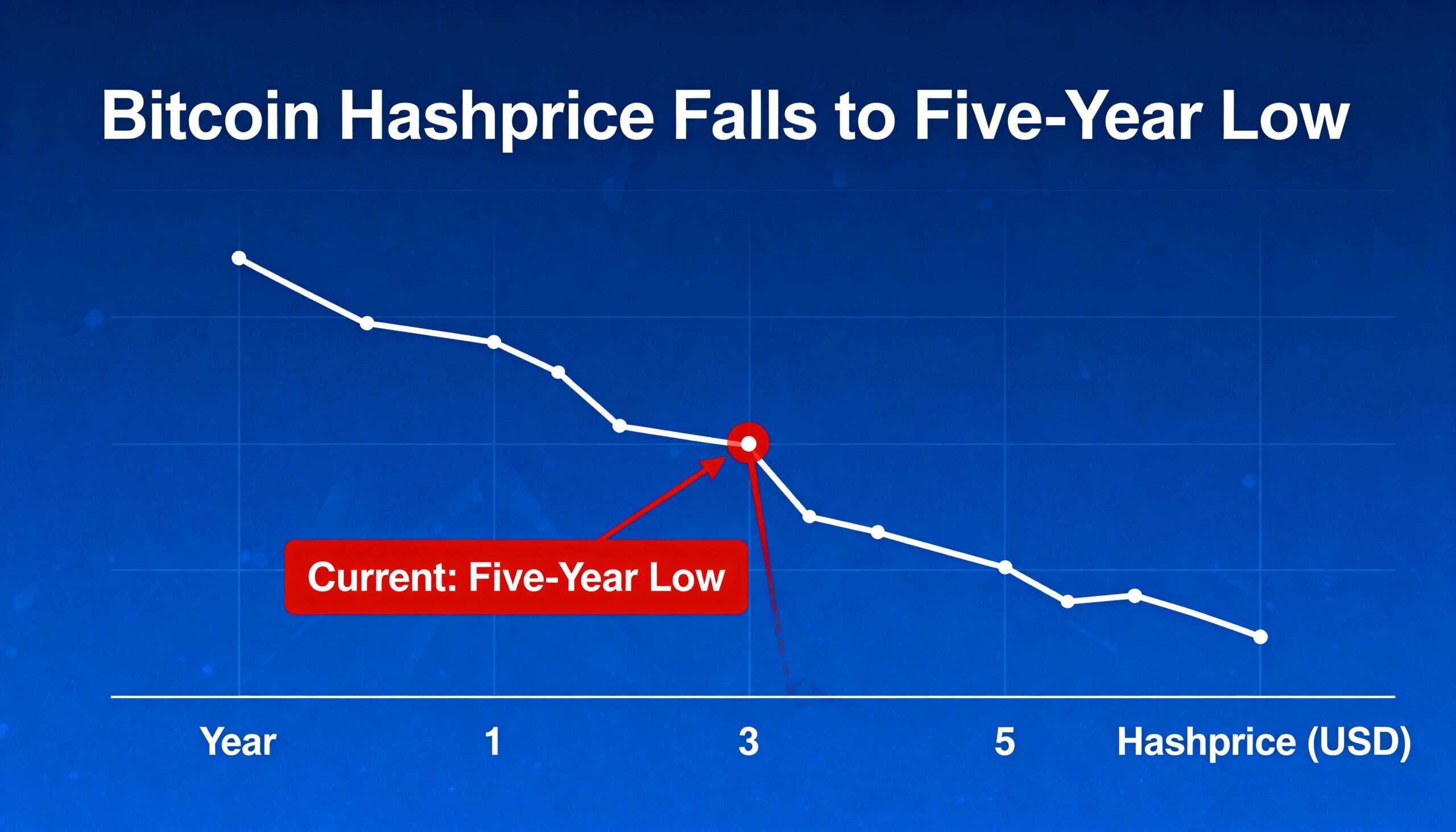

Bitcoin Hashprice Falls to Five-Year Low Amid High Difficulty and Declining Revenue

Bitcoin’s hashprice has dropped to a five-year low of $38.2 per PH/s, according to Luxor. The metric, developed by Luxor, estimates the expected daily revenue from one terahash per second of mining power, typically denominated in USD or BTC.

Hashprice is influenced by four key factors: Bitcoin’s price, network difficulty, block rewards, and transaction fees. It rises when prices or fees increase and declines as difficulty climbs.

Bitcoin’s hashrate remains near record highs at over 1.1 ZH/s on a seven-day moving average, while the price hovers around $91,000—about 30% below October’s all-time high of $126,000. Network difficulty is near all-time highs at 152 trillion, and transaction fees remain low, with high-priority transactions costing just $0.25 (2 sat/vB), according to mempool.space.

The hashprice drop has coincided with broader declines in publicly traded Bitcoin mining stocks, even as many miners pivot to AI infrastructure initiatives. The CoinShares mining ETF (WGMI) has fallen 43% from its peak, trading just below $41.

Share this content: