Bitcoin’s retreat is accelerating as a combination of renewed sell flows, shifting macro expectations and bearish derivatives positioning puts the market under sustained pressure, according to several major trading desks.

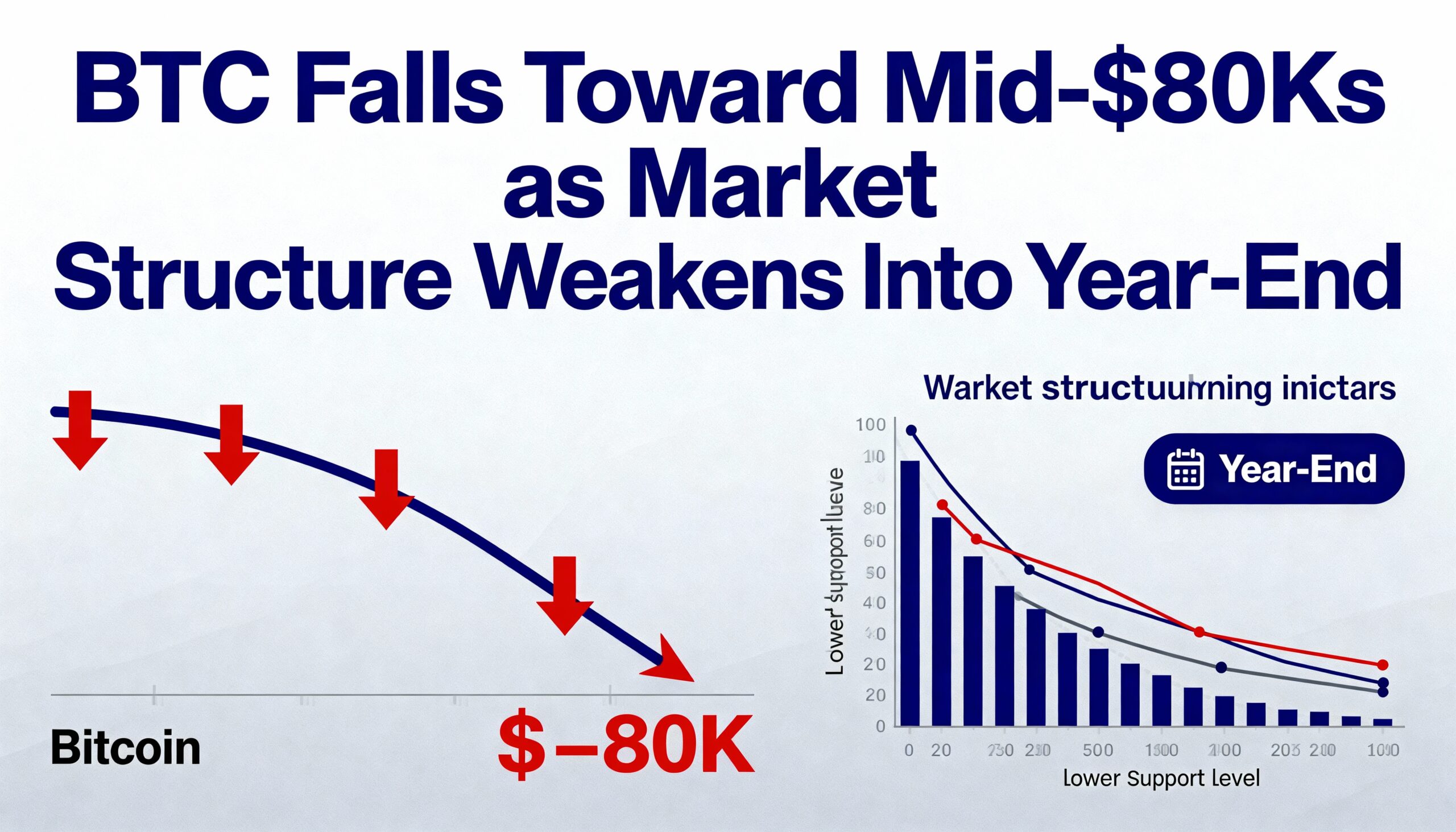

Over the past 24 hours, BTC has dropped more than 7%, extending its monthly decline to over 20%. The fall far exceeds the pullback in equities, which have remained relatively resilient thanks to Nvidia’s strong earnings that helped counter concerns about an AI-led bubble.

Market maker FlowDesk said in a Telegram note that the crypto market is being weighed down by a wave of bitcoin moving out of long-dormant wallets and onto centralized exchanges. Tens of thousands of coins have been reactivated after years of inactivity, creating a steady supply that has overwhelmed buy-side liquidity. As a result, spot flows remain decisively seller-driven.

FlowDesk added that many fund managers are shifting to capital-preservation mode as year-end approaches. Rather than adding exposure, they are protecting existing gains, which has reduced liquidity around key support zones and amplified downside moves.

The derivatives market is showing the same defensive tilt. FlowDesk pointed to increased demand for downside BTC and ETH exposure, with traders rolling their put protection to lower strikes as volatility skews continue to favor bearish bets.

Deribit options data reinforces the trend. As previously reported by CoinDesk, the $85,000 put has now surpassed the once-popular $140,000 call to become the single largest strike by open interest in the entire bitcoin options market—a clear sign that traders are positioning for further declines.

The continued selloff has brought renewed focus to MicroStrategy, with bitcoin edging closer to the company’s average acquisition price of $74,430. JPMorgan noted that the firm’s recent stock weakness reflects rising concerns over a potential MSCI index removal in January. Such a decision could trigger billions in passive outflows, adding yet another pressure point to an already vulnerable crypto market.

Share this content: