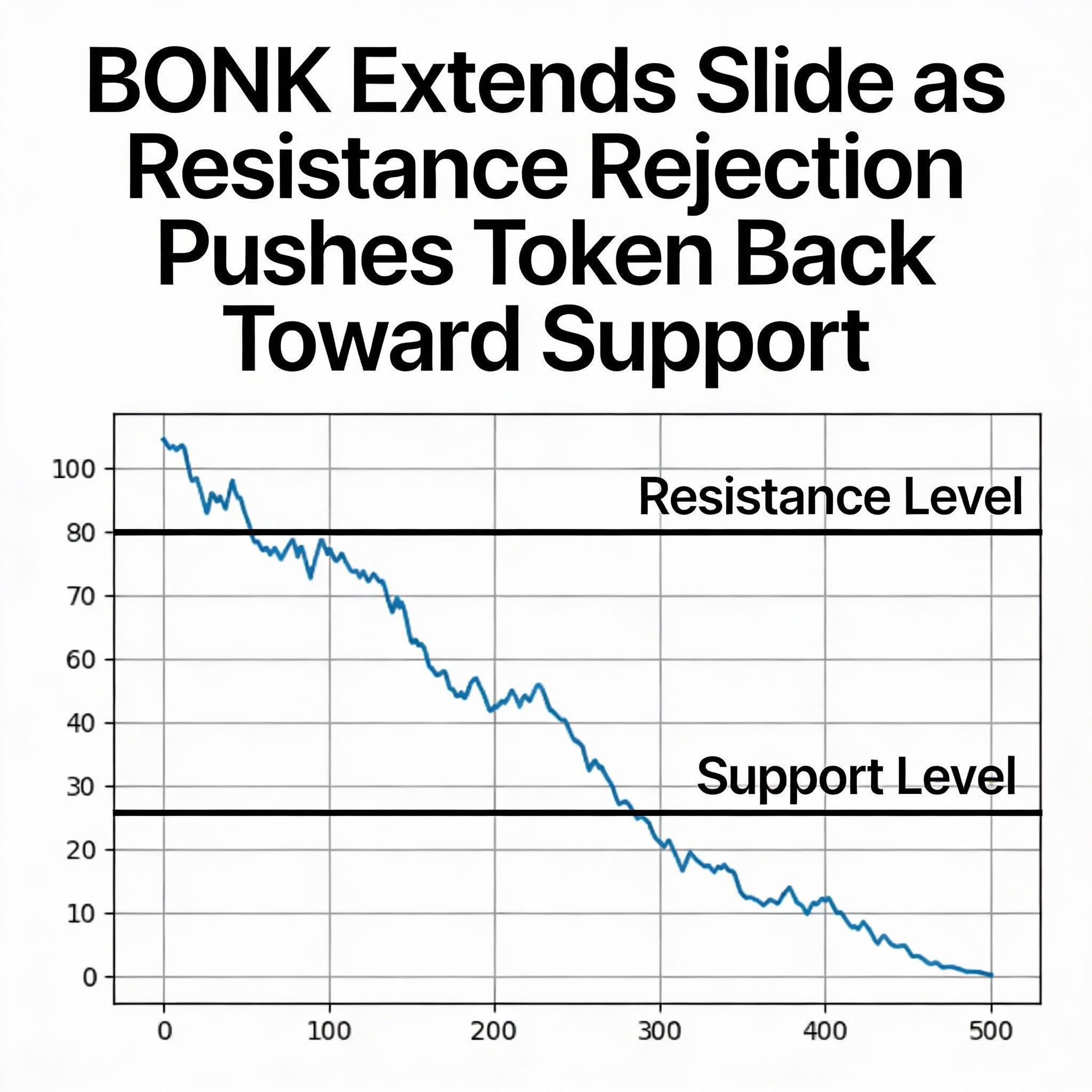

BONK Slides After Failing at Key Resistance, Consolidates Near Support

BONK fell 4.5% over the past 24 hours after an early rally stalled at a major resistance zone, pushing the token back into consolidation near $0.00000910. Price declined from $0.000009524 to $0.000009097 as upside momentum faded quickly following the rejection.

Intraday volatility remained elevated, with BONK trading across an 11.8% range. Prices briefly peaked near $0.00001018 before reversing lower and settling into a tight trading band, according to CoinDesk Research’s technical analysis model.

The pullback was accompanied by a sharp increase in activity, with trading volume climbing to roughly 2.03 trillion tokens as price tested the $0.00001010 area. The surge in volume underscored the level’s importance as a ceiling, where selling pressure overwhelmed buyers. After the rejection, BONK drifted steadily lower before stabilizing above $0.00000910, where volatility compressed later in the session.

Hourly data shows multiple short-lived rebound attempts toward $0.00000915, each met with intermittent volume spikes of around 27.6 billion tokens. This behavior suggests active participation near the lower boundary of the range, with price action beginning to form the early stages of a consolidation base.

Near-term direction now depends on whether BONK can hold above $0.00000910. A sustained move through resistance in the $0.00000915–$0.00000920 zone would help unwind the recent decline, while a breakdown risks a retest of support closer to $0.00000890.

Share this content: