U.S. equities are also losing momentum, with the Nasdaq up just 0.3% after surrendering most of an early rally.

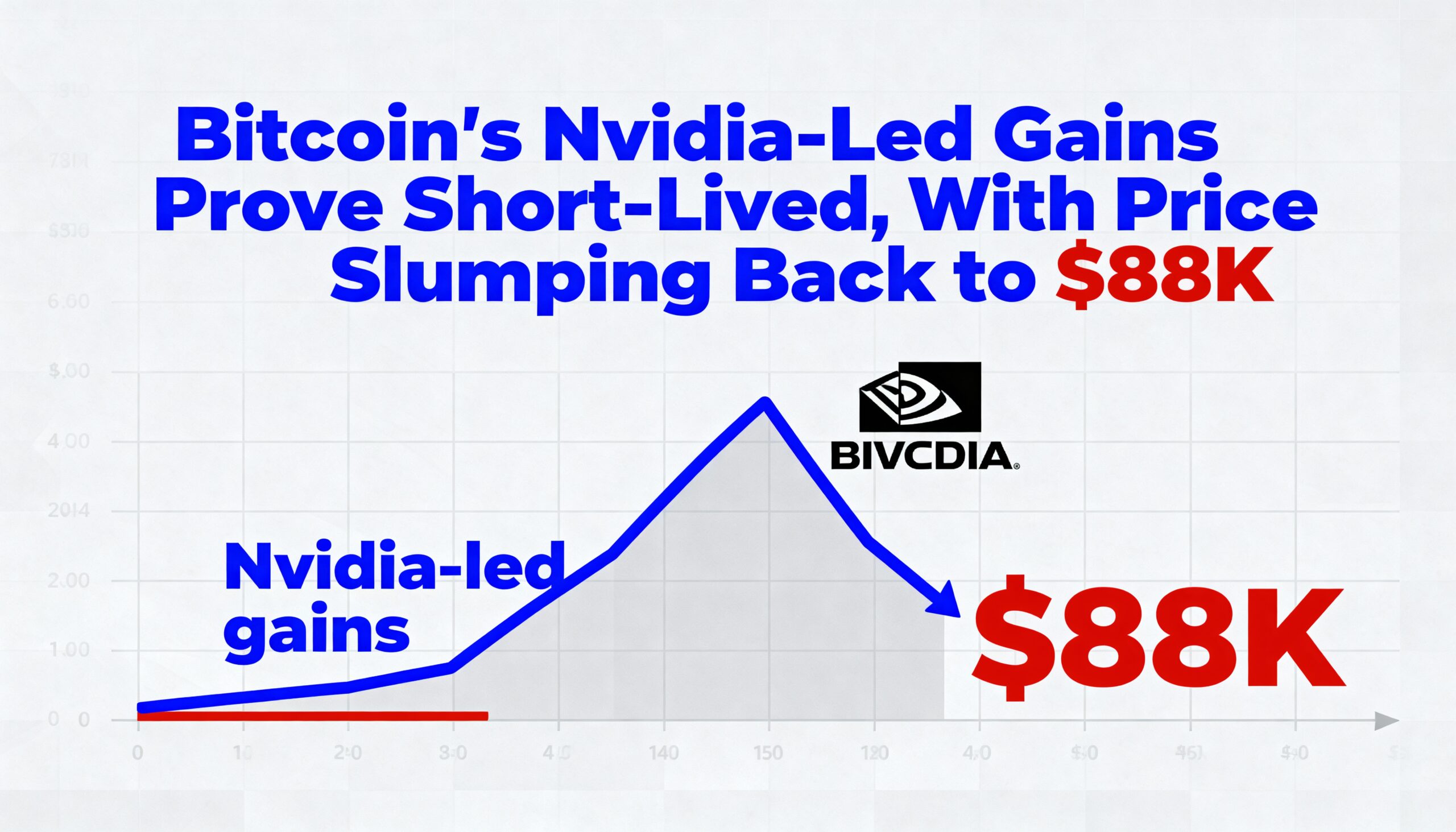

Crypto markets on Thursday repeated a now-familiar pattern: brief upside followed by swift, heavy selling. Bitcoin retreated toward $88,000 after briefly pushing above $93,000 earlier in the day, erasing nearly all of its Nvidia-fueled gains from Wednesday night. Nvidia’s strong earnings and upbeat guidance initially boosted risk sentiment, sending the Nasdaq more than 2% higher and lifting battered crypto assets — but the lift didn’t last.

By midday, Nvidia had slipped back to flat on the session, and stocks broadly reversed. The pullback was reinforced by macro headwinds, including a stronger-than-expected September jobs report that showed 119,000 new positions added after weeks of delay from the government shutdown. The print, combined with hawkish remarks from Cleveland Fed President Beth Hammack — who argued that firm inflation and elevated equity valuations do not justify a rate cut — has further cemented expectations that the Fed will stand pat in December. Her comments echoed the cautionary tone of Alan Greenspan’s famous 1996 “irrational exuberance” warning.

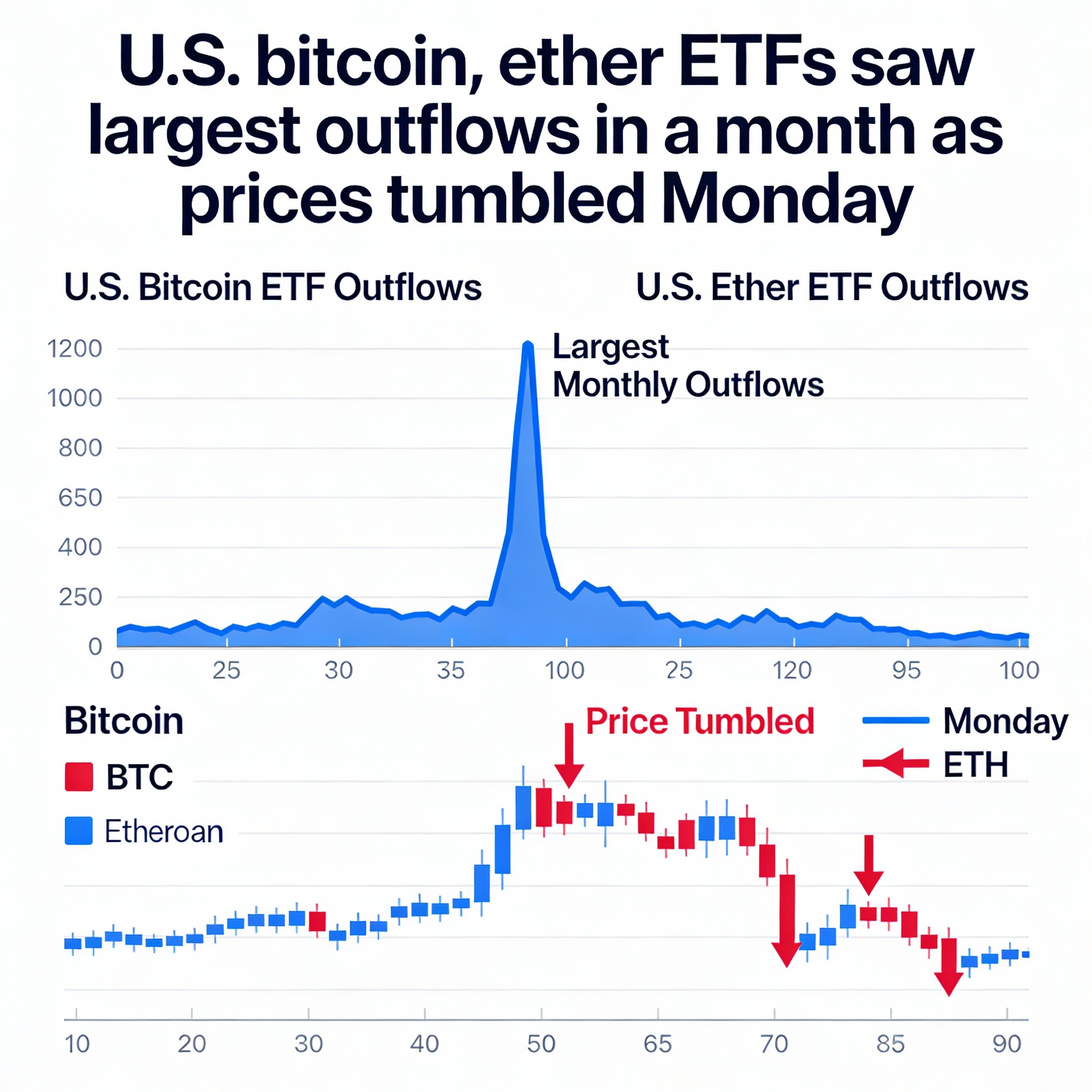

Ether (ETH) slid more sharply than bitcoin, dropping nearly 4% in the past hour. Market participants say part of the pressure may stem from FG Nexus, which reportedly sold a chunk of its ETH reserves to repurchase shares after its stock plunged more than 95% from summer highs.

Crypto-exposed equities turned decisively negative as well. MicroStrategy (MSTR) is down 4.7% and trading at a new 52-week low of $178, marking a 62% decline year-over-year. Coinbase (COIN) and Gemini (GEMI) are lower by 4% and 5%, respectively, while stablecoin issuer Circle (CRCL) has slipped 3.5%.

Share this content: