Bitcoin BTC$90,949.09 sentiment has deteriorated to extreme levels, pointing to a possible short-term market floor, according to a new assessment from 10x Research.

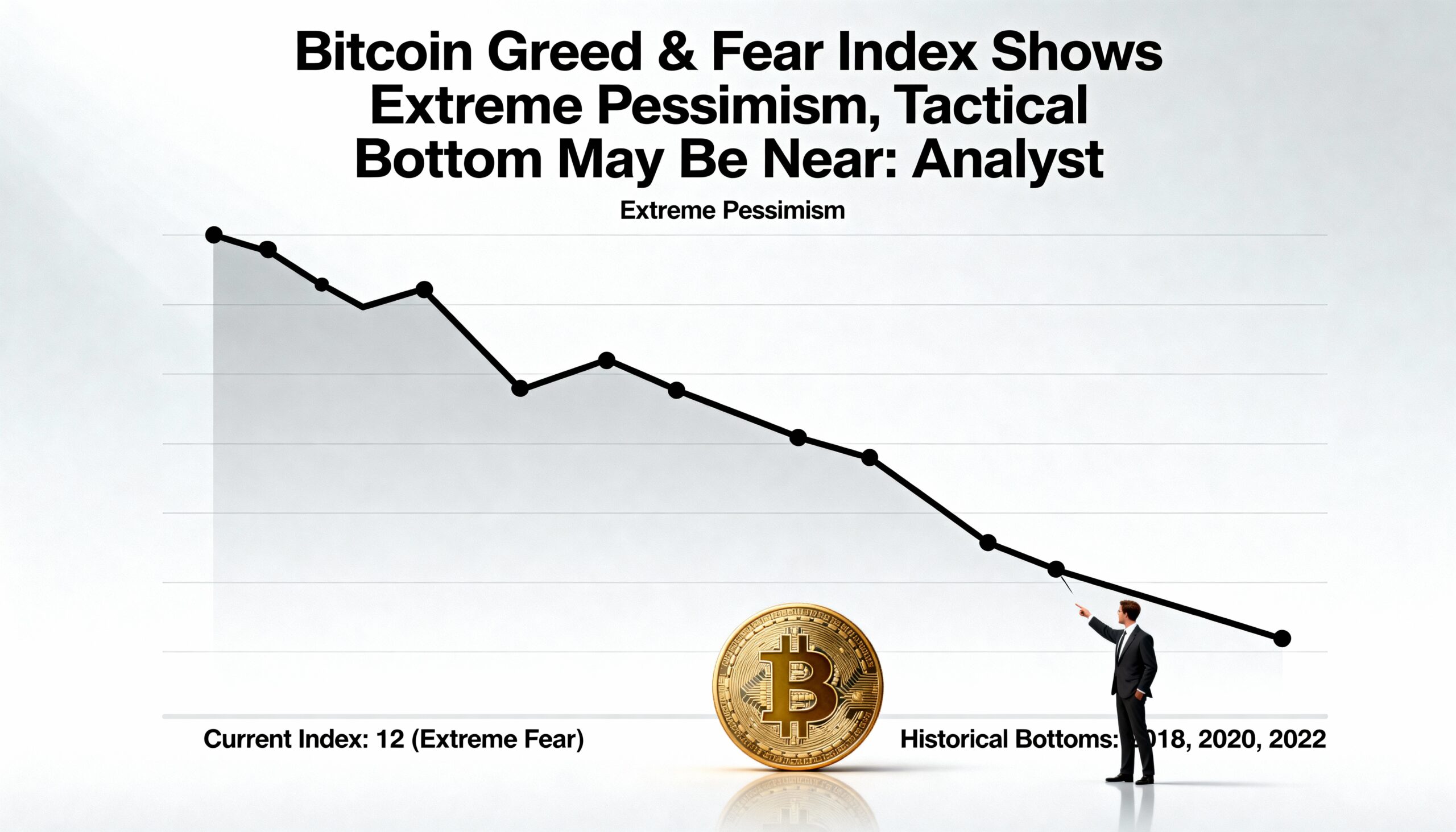

The firm’s Greed & Fear Index, which tracks collective investor sentiment, has dropped below 5, marking its lowest reading on record. Scores under 10% reflect intense fear, while readings above 90% suggest excessive bullishness.

Adding to the signal, the index’s 21-day simple moving average has also fallen to the 10% threshold—a level that has repeatedly coincided with tactical lows in past cycles.

“Our 10x Greed & Fear Index is hovering near its worst possible reading, and the longer-term average has now entered the 10% band, which has historically aligned with tactical bottoms,” said Markus Thielen, founder of 10x Research, in a note to CoinDesk.

Thielen emphasized that extreme pessimism doesn’t guarantee the downtrend has fully run its course. Bitcoin’s price could still soften further, though declines typically moderate once sentiment reaches this stage.

“In March, the indicator bottomed before bitcoin slid further into April,” Thielen said. “But right after that sentiment low, bitcoin still rallied about 10%. With sentiment collapsing again, a similar short-term rebound shouldn’t be ruled out.”

As of press time, bitcoin was trading around $84,800, rebounding from Friday’s $80,880 low, according to CoinDesk data. Despite this recovery attempt, BTC remains down 10% over the past week and 23% during the past month.

Share this content: