Bitcoin extended its weekend rebound on Monday, briefly topping $89,000 as traders grew increasingly confident in a potential December Federal Reserve rate cut. The broader crypto market followed suit, with altcoins leading the recovery as macro pressures eased.

Ether (ETH) climbed 4.4% to just below $3,000, tracking gains in the CoinDesk 20 Index. Crypto-related equities also rallied, particularly miners linked to AI and high-performance computing. Amazon’s announcement of a $50 billion investment in U.S. AI and supercomputing infrastructure further fueled the sector. CleanSpark (CLSK) and Cipher Mining (CIFR) surged 18%, while Hut 8 (HUT), Bitfarms (BITF), IREN, HIVE, and TeraWulf (WULF) all recorded double-digit gains.

Even distressed digital asset treasuries posted strong recoveries. Ethereum-focused BitMine (BMNR) jumped nearly 20%, Solana Company (HSDT) rose over 16%, and Avalanche treasury AVAX One (AVX) added 10.4%. Bitcoin treasury firms Strive (ASST) and MetaPlanet (MTPLF) climbed 10.7% and 8.7%, respectively, while MicroStrategy (MSTR) gained 5%.

The crypto upswing coincided with a broader equity market rebound. The Nasdaq rose 2.6%, and the S&P 500 advanced 1.5% following last week’s sell-off.

Market optimism was further bolstered by comments from San Francisco Fed President Mary Daly, who voiced support for a December rate cut, citing vulnerabilities in the labor market. Daly’s position aligns with Fed Chair Jerome Powell, amplifying its impact. CME FedWatch data shows traders now price an 85% chance of a 25-basis-point cut at the Dec. 10 meeting, up from 42% just a week ago.

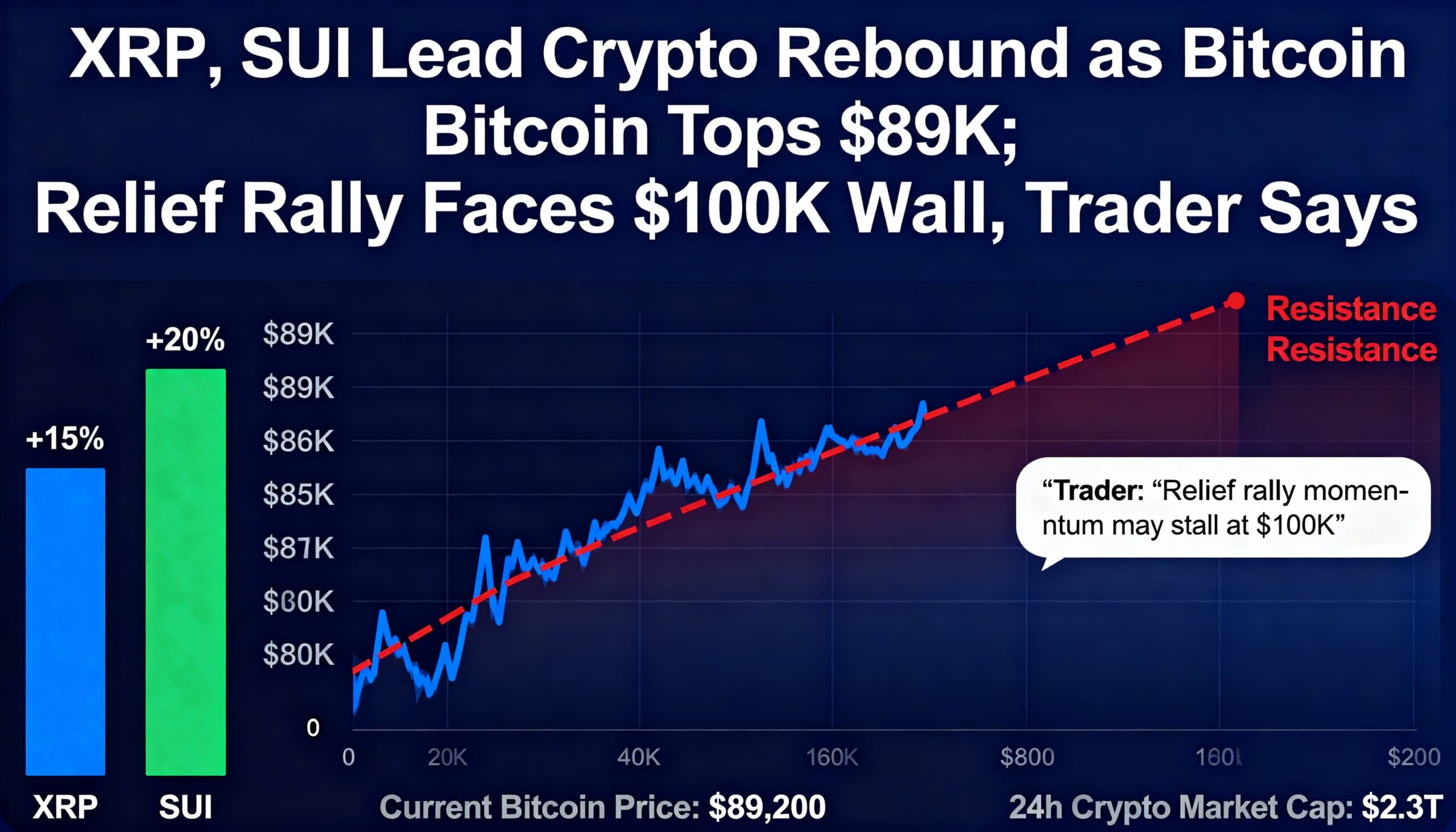

$100K Resistance Looms

Despite the relief rally, analysts caution that Bitcoin faces a major hurdle near $100,000.

“Digital assets have been caught in the macro unwind, but the market is now positioned for consolidation,” said Jasper De Maere, OTC trader at Wintermute. He noted that neutral-to-negative funding rates, lower leverage, and healthy spot volumes suggest a more orderly recovery.

With leverage largely flushed out, De Maere expects the rebound to continue gradually, rather than as a rapid surge toward the $100,000 mark.

Share this content: