Crypto markets moved sharply higher on Wednesday as bitcoin, ether and a wide slate of altcoins rallied, though Zcash (ZEC) continued to diverge with another steep decline.

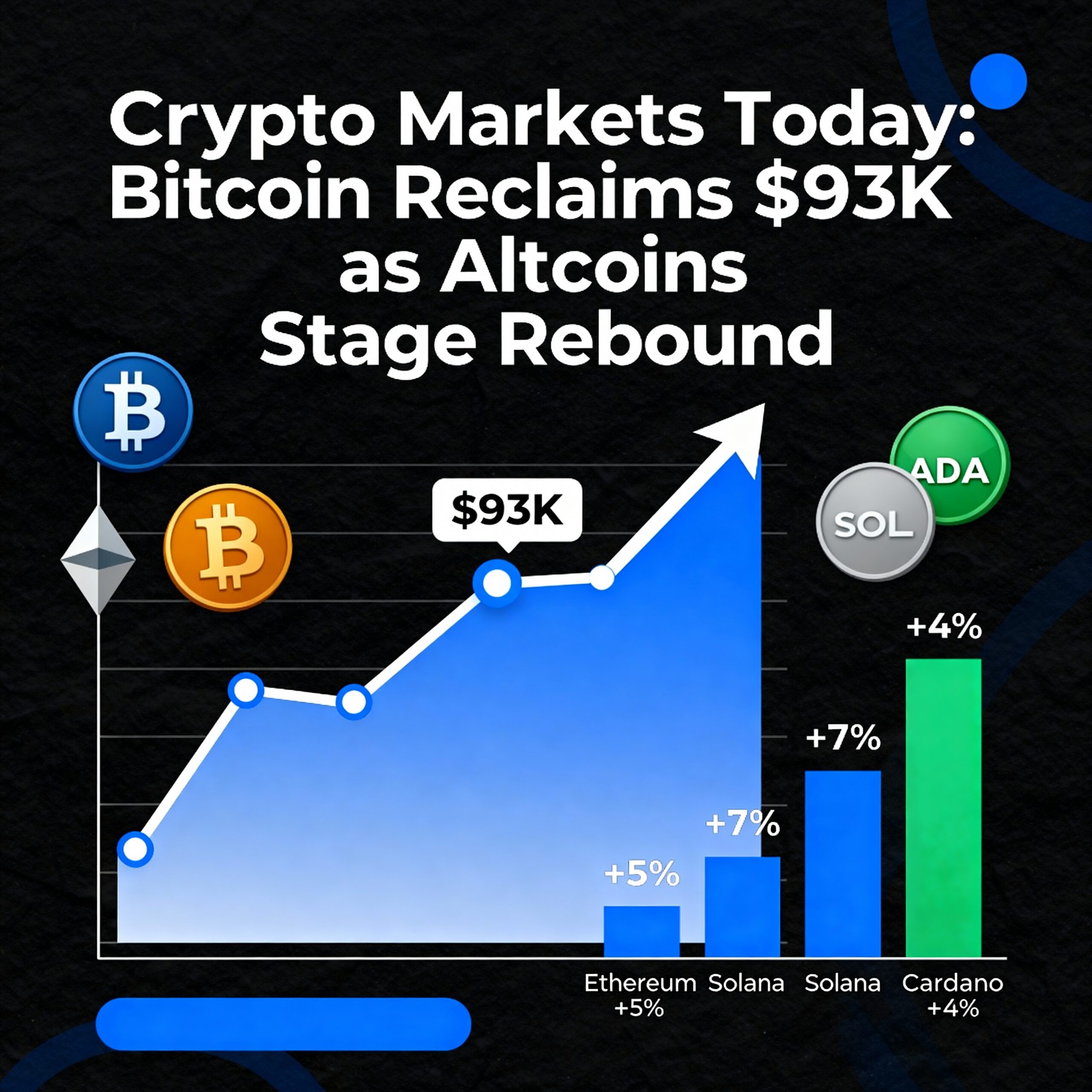

Bitcoin led the rebound with a 6.6% jump over 24 hours, pushing the largest cryptocurrency back to $93,000. Ether followed suit, reclaiming the $3,050 level after several sessions of sluggish trading.

Zcash, however, remained firmly on the back foot. After months of outsized gains, the privacy token has now dropped more than 38% in the past week as traders unwind heavily overbought positions.

Derivatives activity reflected the renewed momentum. Trading volume on perpetual futures markets climbed over 5% to $44 billion in the past day, signaling that the recovery was supported by both spot demand and an uptick in leveraged positioning.

Open interest (OI) increased across BTC, ETH and a range of large-cap tokens, suggesting steadier demand for leveraged exposure. SUI, SOL, BNB and ADA posted the strongest OI gains. Funding rates stayed broadly positive, highlighting a market still tilted toward long positions, with TRX and WLFI the main exceptions.

Institutional activity on the CME told a different story. Open interest in standard bitcoin futures slid to 121,670 contracts—its lowest reading since February 2024. BTC options OI also declined to 46,000 BTC, giving back all the growth seen since early October. Interest in CME’s regulated crypto products appears to be cooling.

Ether derivatives followed a similar pattern: futures open interest fell to 1.95 million ETH, the lowest since September, while options OI dipped to 275,000 ETH after recently topping 350,000 ETH.

On Deribit, BTC and ETH put options continue to trade at premiums to calls, though the spread has narrowed since the start of the week. Block trades were dominated by BTC strangles and call butterflies, alongside ether put spreads and diagonal call calendars.

Altcoins broadly outpaced bitcoin’s 6.5% advance. SUI and Chainlink’s LINK were among the strongest movers, surging 30.8% and 24%, respectively. The broad-based strength suggests the downtrend that has persisted since early October is weakening, leaving room for a potential shift toward bullish sentiment.

Liquidity conditions remain fragile despite the rally. Market depth has yet to recover from October’s sharp sell-off, heightening the chance of exaggerated price swings and increasing vulnerability should negative headlines emerge.

Zcash extended its slump with another 3% decline in the past 24 hours, deepening its seven-day drop to 38% as investors take profits following its strong run between September and November.

Meanwhile, the “altcoin season” indicator sits at 21/100—near record lows—showing that despite isolated bursts of altcoin strength, overall market focus remains firmly centered on bitcoin rather than speculative rotation.

Share this content: