Volatility again proved fleeting in crypto markets, with even a modest rally quickly fading under selling pressure.

The Supreme Court of the United States on Friday struck down President Donald Trump’s tariff framework in a 6–3 ruling, declaring that the administration had exceeded its statutory authority.

“No President has invoked the statute to impose any tariffs, let alone tariffs of this magnitude and scope,” the majority opinion stated. The court added that the lack of historical precedent, combined with the breadth of authority claimed by the executive branch, suggested the measures extended beyond the president’s “legitimate reach.”

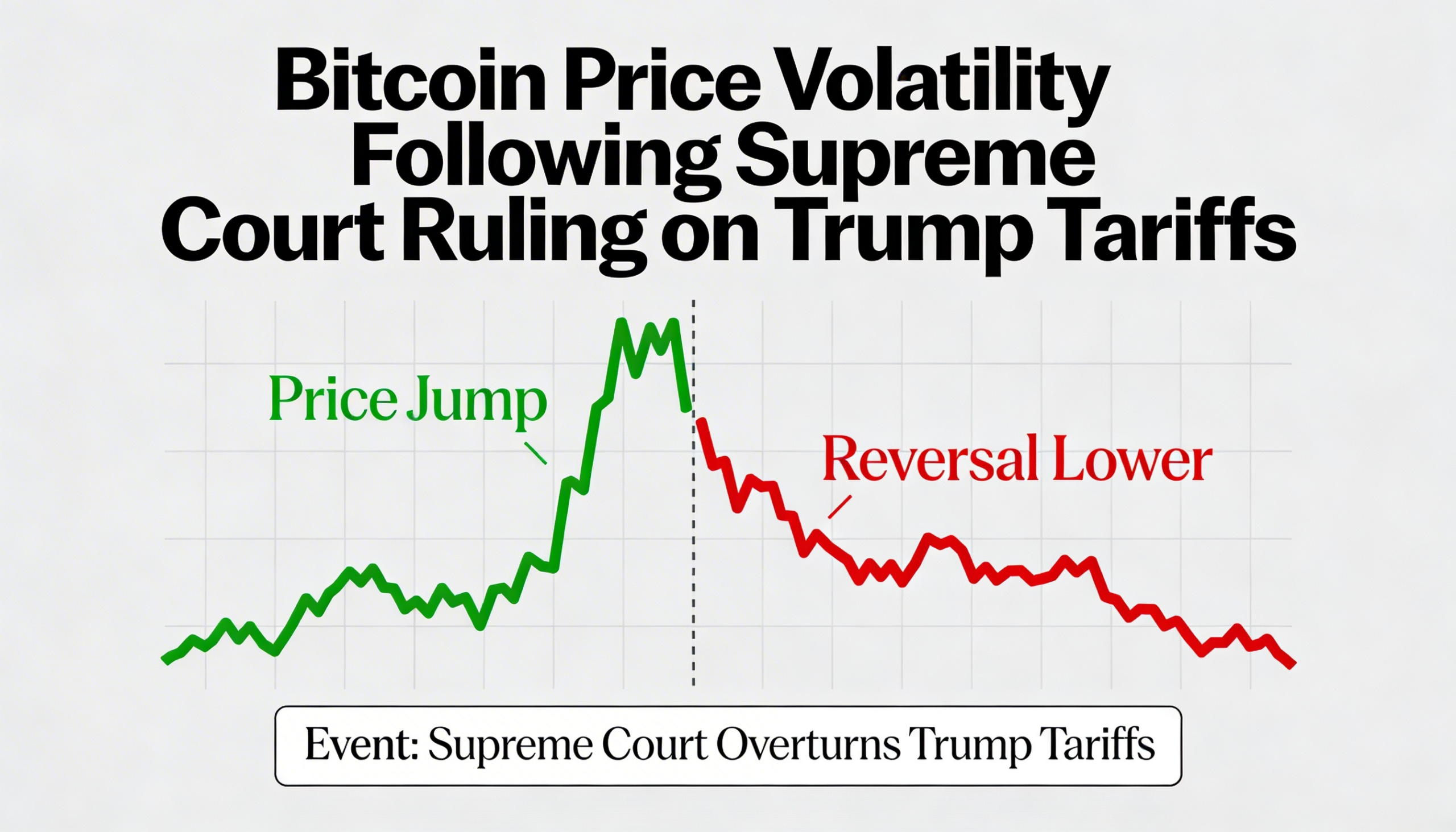

Bitcoin’s brief spike

Bitcoin initially reacted with a sharp move higher, climbing roughly 2% and briefly pushing above $68,000. However, the rally quickly lost momentum. Within minutes, prices retreated to just under $67,000, underscoring the fragile tone that has characterized crypto trading in recent sessions.

The short-lived advance contrasted with steadier gains in equities. The tech-heavy Nasdaq Composite rose 0.6% to a session high, suggesting a more sustained risk-on response in traditional markets.

Signs of stagflation

Earlier in the day, fresh U.S. economic data pointed to a mixed macro backdrop. According to the United States Department of Commerce, the economy expanded at a 1.4% annualized pace in the final quarter of 2025 — a modest showing.

At the same time, core personal consumption expenditures (PCE) prices increased 3% year-over-year, exceeding expectations of 2.9% and accelerating from 2.8% previously. On a full-year basis, economic growth came in at 2.2%, marking the slowest expansion since 2020.

Art Hogan, chief market strategist at B. Riley Wealth, said the data painted a complicated picture. “Today’s economic data delivered a messy message of both hotter than expected inflation and slower than anticipated growth,” he noted, adding that the mixed signals reinforce the Federal Reserve’s cautious approach to monetary policy.

For crypto markets, the combination of policy uncertainty, sticky inflation, and softening growth continues to create an environment where rallies struggle to gain traction.

Share this content: