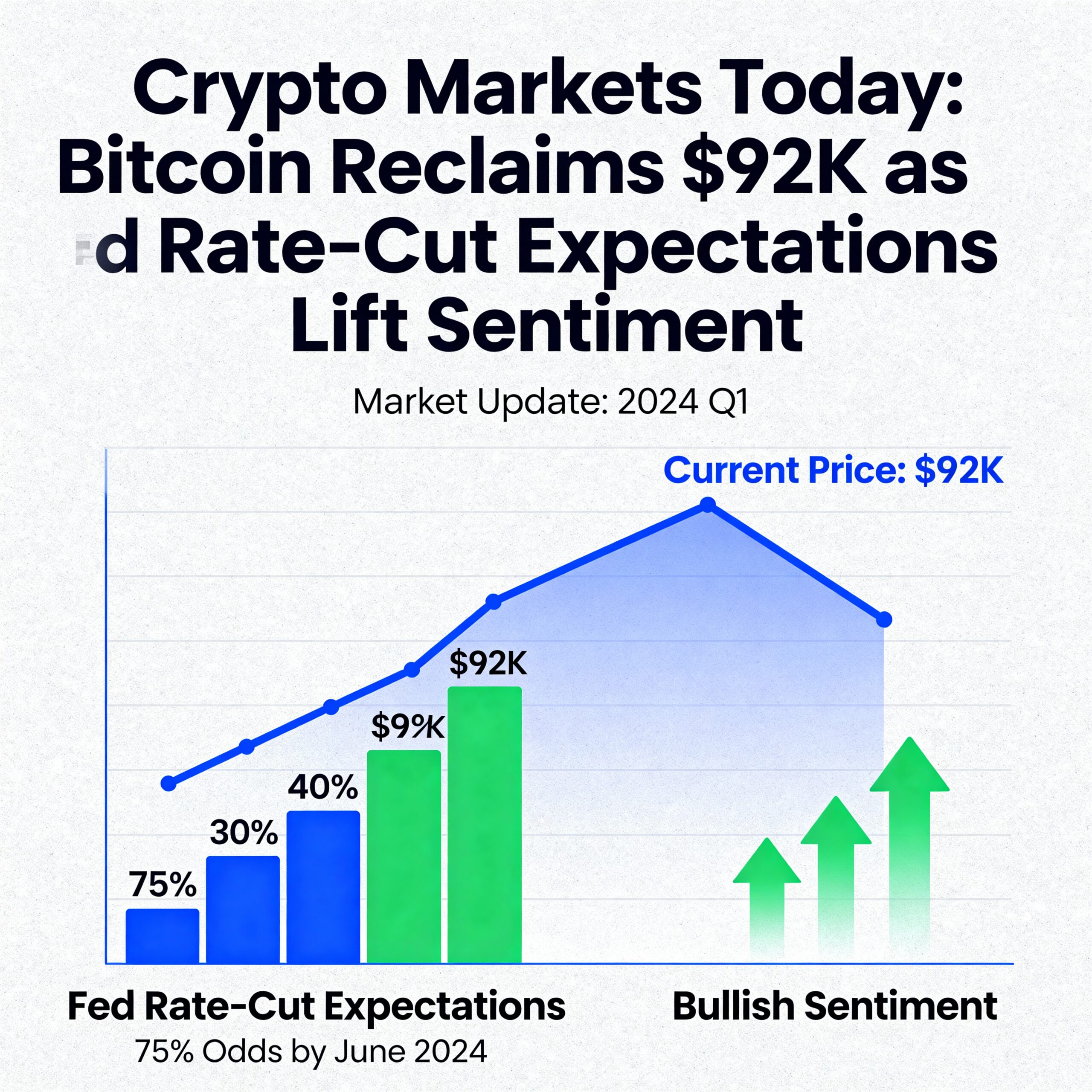

Bitcoin Climbs Above $92K as Fed Rate-Cut Optimism Lifts Market, Altcoins Lag

Bitcoin surged past $92,000 during Monday’s Asia session, buoyed by growing expectations of a Federal Reserve rate cut this week, while most altcoins remained under pressure.

After spending the weekend below $90,000, Bitcoin reversed Friday’s sell-off and is now approaching last week’s high of $94,200. U.S. equity futures also gained roughly 0.2% from Sunday’s open, with traders pricing in a 25-basis-point Fed cut on Wednesday—CME data shows an 87% probability.

Derivatives and Market Positioning

Bitcoin and Ether have gained 3%-4% over the past 24 hours, yet broader altcoins remain weak due to limited speculative activity.

- BTC’s 30-day implied volatility (BVIV) holds steady around 50%, suggesting calm ahead of the Fed announcement.

- ASTER and ENA led growth in futures open interest for major tokens.

- Perpetual funding rates for BTC and ETH remain positive, reflecting bullish leverage, partially driven by the unwinding of short futures in cash-and-carry trades.

- On Deribit, BTC and ETH puts trade pricier than calls, indicating lingering downside concerns. The $20K BTC put is currently the second-most popular June 2026 options bet.

- Block flows show strong demand for BTC call spreads and strangles, while ETH call calendar spreads dominate recent flows.

Altcoin Market Weakness

The “altcoin season” indicator dropped to a record low of 19/100, signaling investor reluctance to speculate beyond market leaders. Since Dec. 1, the CoinDesk 20 (CD20) index has risen 1.34%, while the broader CoinDesk 80 (CD80) index has fallen 1.37%.

- Memecoins and metaverse tokens continue to underperform, down 53% and 62%, respectively.

- Privacy coins outperform, with Zcash up 17% over 24 hours, extending its year-to-date gain to 600%.

- Conversely, TIA, the native token of its data-availability blockchain, has lost more than 87% this year amid inactivity and recent layoffs.

In summary, Bitcoin and top-tier tokens show renewed strength ahead of the Fed decision, while most altcoins remain muted as investor focus narrows to market leaders.

Share this content: