Bitcoin’s attempt to recover from last week’s sharp selloff is showing early signs of fatigue, as weakening trading activity and fading retail participation point to a broader risk-off shift across crypto markets.

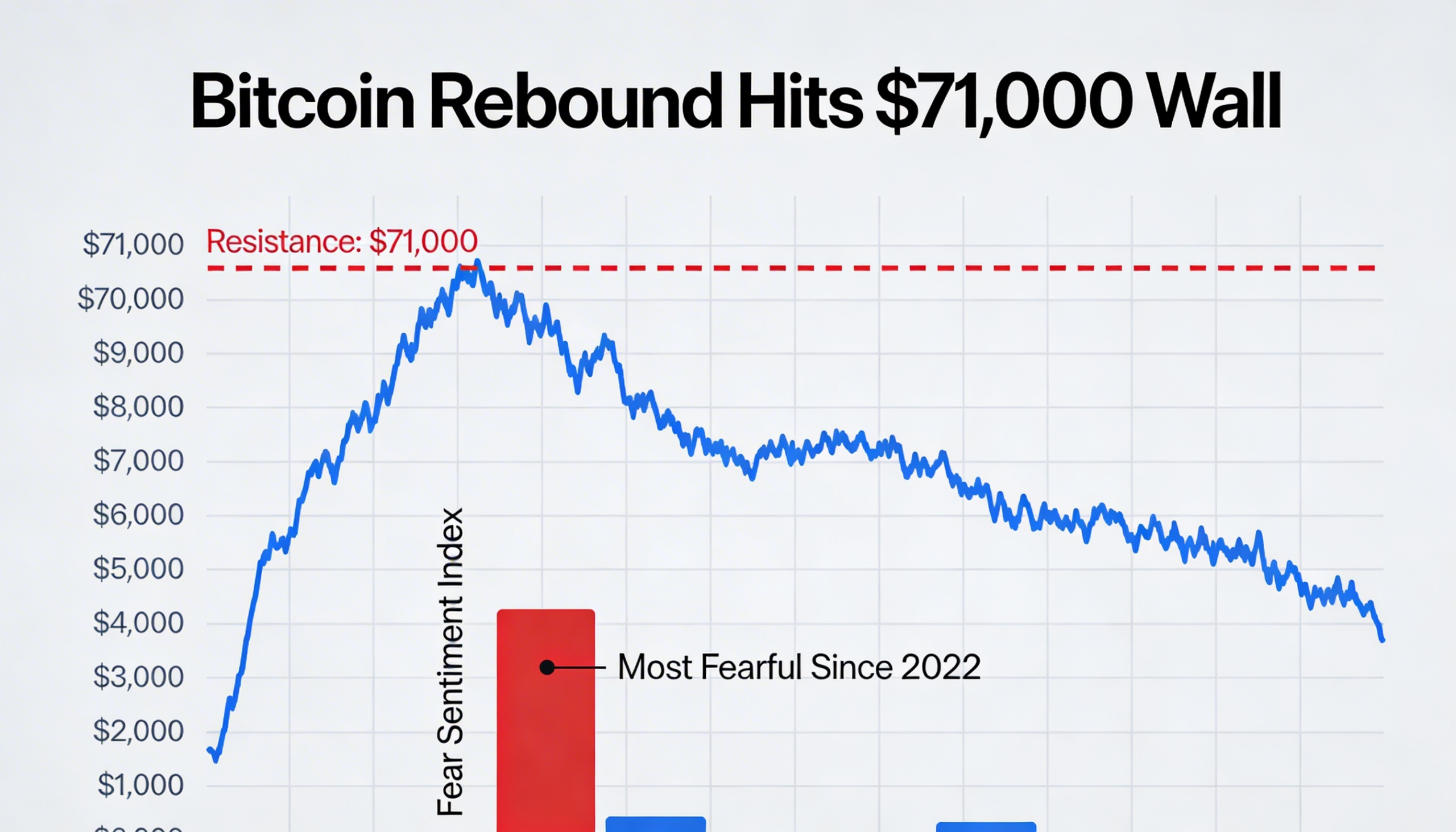

After plunging into the low-$60,000 range in what many traders described as a capitulation-style flush, bitcoin (BTC) mounted a swift rebound over the weekend, briefly approaching the $70,000 level. But the advance has since stalled, raising questions about whether the move represents a sustainable recovery or merely a temporary reprieve within a larger downtrend.

The pattern resembles a classic bear-market rally: a rapid bounce that lures dip buyers before running into heavy overhead supply from investors seeking to exit at improved prices.

“There’s still substantial supply from participants looking to sell into strength,” said Alex Kuptsikevich, chief market analyst at FxPro. Given the loss of momentum, he warned that bitcoin could soon retest its 200-week moving average — a level widely watched as long-term support.

Kuptsikevich added that selling pressure near the $2.4 trillion total crypto market capitalization mark underscores his cautious outlook. “It’s possible we’ve only seen a rebound within a broader decline that has yet to fully unfold,” he said.

Sentiment indicators reflect similar fragility. The Crypto Fear and Greed Index plunged to 6 over the weekend — matching levels last seen during the FTX crisis in 2022 — before recovering slightly to 14 by late Monday. Despite the bounce, the gauge remains deep in extreme fear territory.

According to Kuptsikevich, such depressed readings are typically inconsistent with strong, conviction-driven buying and suggest lingering structural concerns rather than fleeting anxiety.

Liquidity conditions are compounding volatility. With thinner order books across exchanges, relatively modest selling pressure can trigger exaggerated price moves. Those swings often cascade into additional stop-losses and forced liquidations, amplifying volatility in a reflexive cycle that leaves price action looking erratic.

That structural dynamic, rather than any single headline catalyst, helps explain why bitcoin can experience multi-thousand-dollar intraday swings while repeatedly failing to break above key resistance levels.

A recent note from market data provider Kaiko described the broader backdrop as a risk-off unwind. The firm reported that aggregate volumes across major centralized exchanges have declined by roughly 30% since late 2025. Monthly spot volumes, once around $1 trillion, have slipped closer to $700 billion.

Although last week featured short-lived bursts of elevated trading, Kaiko said the overarching trend remains a gradual cooling in participation. Retail investors appear to be stepping away incrementally rather than exiting in a dramatic wave of panic.

In such an environment, prices can drift lower on relatively light selling pressure, without the kind of heavy, climactic volume that typically signals a definitive capitulation and longer-term bottom.

Kaiko also placed the correction within the framework of bitcoin’s four-year halving cycle. After reaching a peak near $126,000 in late 2025 or early 2026, the asset has retraced sharply. The retreat into the $60,000–$70,000 range represents a drawdown of more than 50% from its highs.

Historically, major cycle bottoms tend to form over extended periods and often include multiple failed recovery attempts before a durable uptrend takes hold.

For now, the $60,000 area remains a critical battleground. Sustained defense of that level could lead to a choppy consolidation phase. A decisive breakdown, however, may quickly revive the same thin-liquidity dynamics that intensified last week’s selloff — especially if broader macro conditions continue to favor risk aversion.

Share this content: