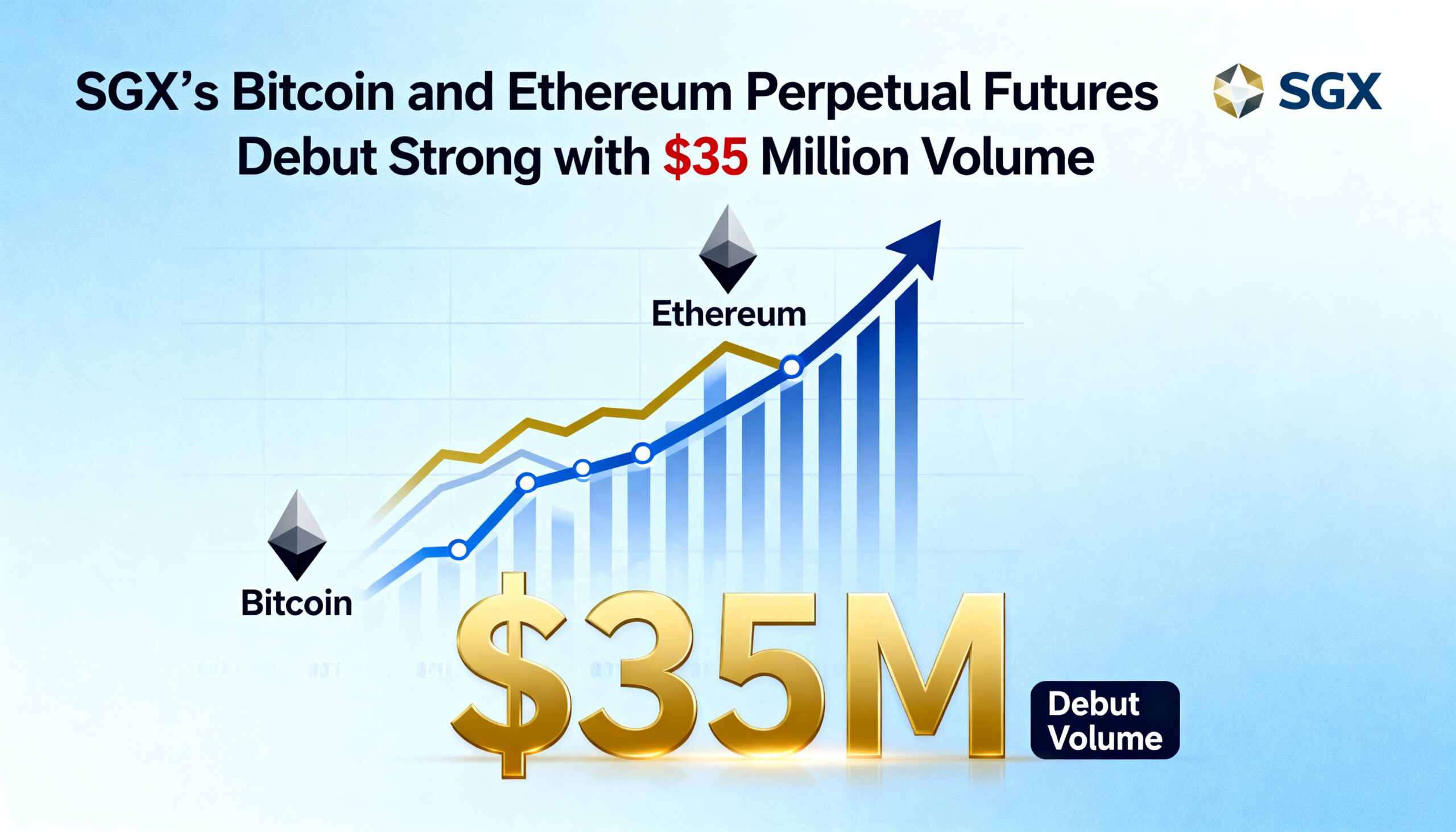

SGX Launches Bitcoin and Ethereum Perpetual Futures with Strong Debut

SGX Derivatives’ Bitcoin (BTC) and Ether (ETH) perpetual futures made a strong debut on Monday, signaling robust institutional interest in regulated crypto derivatives.

Nearly 2,000 lots traded on day one, representing about $35 million in notional value, while open interest closed at 58 lots, or roughly $1 million, according to SGX. Tight bid-ask spreads and stable funding rates of 3 basis points reflected solid liquidity from the start.

The launch was backed by eight prominent clearing members — Bright Point International, Guotai Junan Futures, KGI Securities, Marex, Nanhua Singapore, Orient Futures, Phillip Nova, and StoneX Financial — reinforcing Singapore’s role as a regional hub for digital asset trading.

Perpetual futures allow traders to speculate on asset prices without an expiration date, offering continuous funding, high leverage, and price discovery. Designed for institutional participants, these contracts benefit from Singapore’s AAA credit rating and strong risk infrastructure, bridging traditional finance with crypto in a secure, professional environment.

The successful debut highlights the maturation of institutional crypto markets, providing a trusted avenue for experienced investors in Asia and beyond.

Share this content: