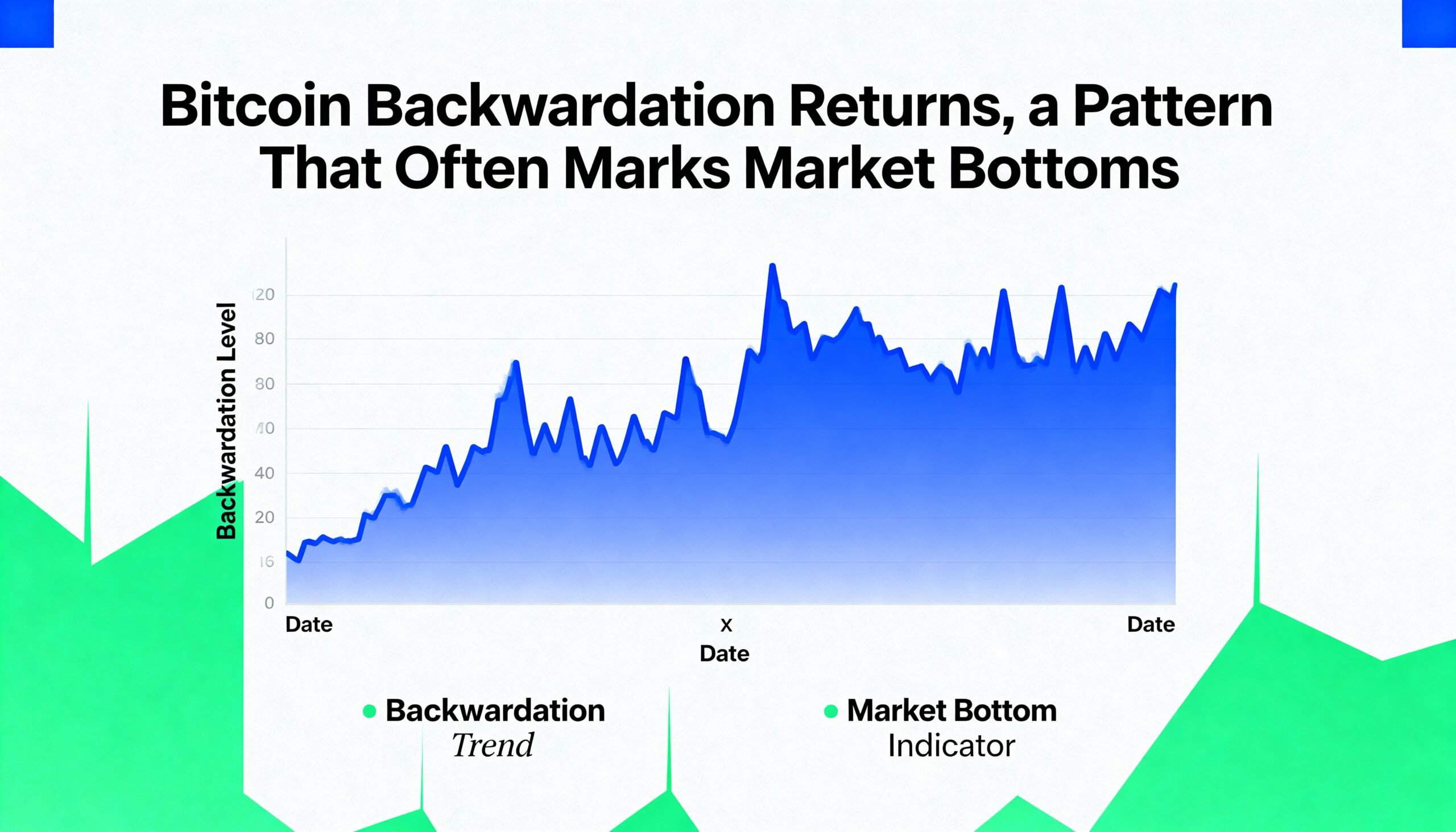

Bitcoin Slips Into Backwardation as Futures Sink Below Spot, Flashing a Classic Market-Bottom Signal

Bitcoin’s futures curve has flipped into backwardation, a rare condition in which near-dated contracts trade below the spot price — a setup typically linked to fear-driven selling, forced hedging and market stress. The shift comes as BTC extends a nearly 30% pullback from its all-time high.

Thomas Young, managing partner at RUMJog Enterprises, highlighted the development in an X post, noting that backwardation “doesn’t occur often” in bitcoin and usually appears during episodes of “stress, forced de-risking, or capitulation.” Historically, those moments have marked key reversal zones.

Young said markets emerging from backwardation generally take one of two paths: either a quick recovery once panic fades or a final washout that completes the correction. Both outcomes have previously aligned with local or major cycle lows.

Backwardation’s track record supports that view.

• It coincided with the exact cycle bottom near $15,000 during the FTX collapse in November 2022.

• It reappeared in March 2023 as BTC briefly dipped below $20,000 during the SVB banking shock and USDC depeg.

• It surfaced again in August 2023 during the Grayscale ETF-driven sell-off toward $25,000, which quickly reversed.

The three-month annualized basis — a measure of the spread between spot BTC and futures — has now compressed to roughly 4%, its lowest level since late 2022. The basis typically reflects a modest premium as traders pay for forward exposure, reaching as high as 27% in March 2024 when bitcoin hit $73,000.

The collapse of that premium signals fading appetite for leveraged long positioning and a broader shift toward caution. While bitcoin generally trades in mild contango, moments of extreme sentiment can push the curve sharply negative, as seen now.

Overall, the move into backwardation points to a market still digesting the recent drawdown — but one that, historically, has often been close to forming a durable bottom.

Share this content: