Bitcoin Diverges from Power Law: Is a Rebound Coming?

Bitcoin is trading well below the Power Law model, raising questions about whether a mean reversion is on the horizon or if the model itself is being challenged.

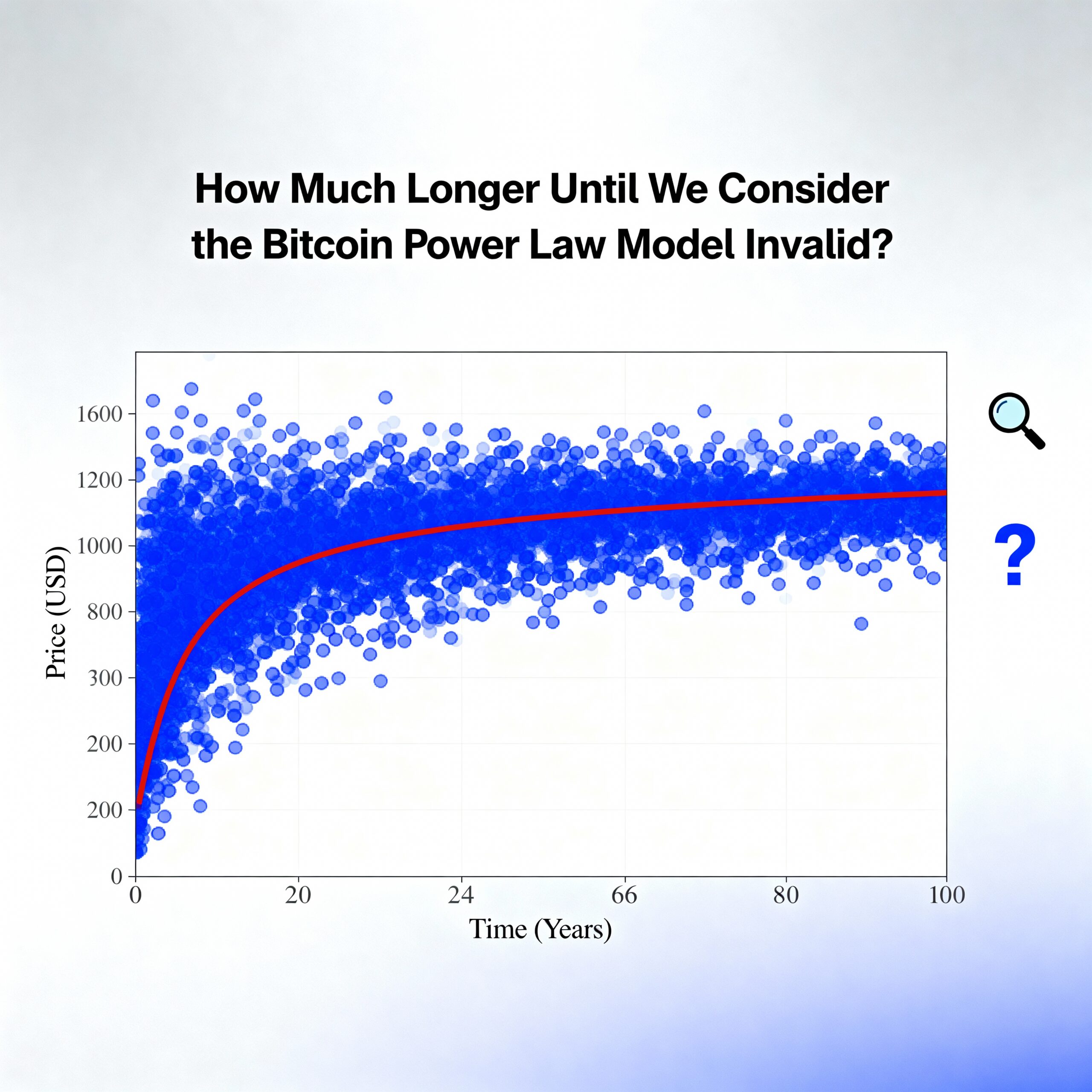

While all long-term bitcoin valuation frameworks eventually break down, the Power Law has remained relatively reliable this cycle. Historically, bitcoin overshot the model in bull markets and dipped below it in bear markets. In contrast, current prices have largely followed the model’s trajectory.

The Power Law maps bitcoin’s long-term trends mathematically, showing that price historically follows a logarithmic power law distribution. Although useful for structural insights, it is backward-looking and not a guaranteed predictor of future prices.

At present, bitcoin trades below $90,000, roughly 32% under the model’s $118,000 level, the largest deviation since the August 2024 yen carry trade unwind, which saw a 35% gap and took three months to recover.

Meanwhile, models like PlanB’s Stock-to-Flow have long been invalid, implying unrealistic prices above $1 million today.

The key question: will bitcoin revert to the Power Law trend, or could it fall further, challenging yet another valuation model?

Share this content: