Bitcoin Weakens as Market Demand Fades, Eyes $85K Retest

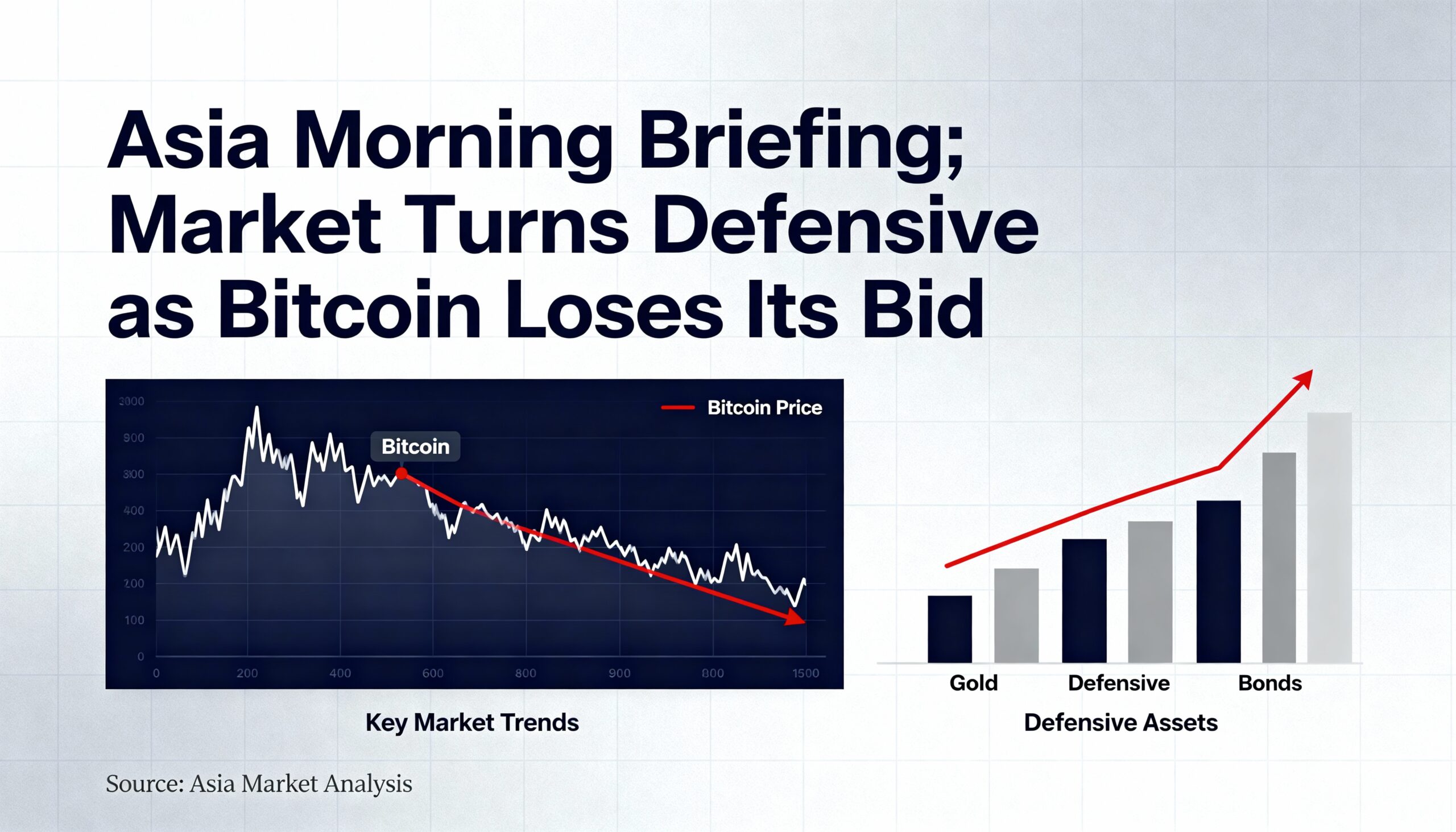

Bitcoin is showing signs of a softer market structure as the buying that sustained prices earlier this year begins to fade. CryptoQuant reports that the cycle’s core demand wave has largely passed, with ETF accumulation slowing, Treasury-company purchases vanishing, and Strategy buys hitting their lowest levels of the year.

While this does not signal an immediate crash, upside potential is limited, with rallies likely to stall below the 365-day moving average until a new wave of demand emerges.

Polymarket traders are reflecting this cautious sentiment, assigning the highest probability to a retest of $85,000 while giving little weight to upside scenarios.

Market Signals Turn Defensive

Glassnode notes that short-term holders are realizing losses at the fastest pace since the FTX period. ETF flows remain negative, and derivatives markets have shifted into risk-off mode, with options traders favoring puts and implied volatility climbing.

The Active Investor cost basis near $88,600 represents the next critical level. A sustained move below this point would place recent investors into losses for the first time this cycle and signal growing bearish momentum. The next key support is the True Market Mean around $82,000, which could mark the start of a bear market phase similar to 2022–2023 if broken.

The coming weeks will determine whether buyers can regain control or if the downturn deepens.

Market Snapshot

- Bitcoin (BTC): Trading near $92,000 after briefly dipping below $90,000 earlier this week.

- Ether (ETH): Around $3,038, tracking Bitcoin’s defensive tone.

- Gold: Near $4,067, after an intraday high of $4,132 amid rising risk aversion.

- Nikkei 225: Up 3.7% Thursday, buoyed by strong Nvidia earnings and chip sector gains.

Crypto Highlights

- Samourai Wallet Co-Founder Bill Hill sentenced to four years for unlicensed money transmitting (CoinDesk).

- New Hampshire unveils $100 million Bitcoin-collateralized municipal bond (Decrypt).

- Bullish reports Q3 profits after adding options and U.S. spot trading (CoinDesk).

Share this content: