Asia Market Snapshot: QCP Says Global Liquidity, Not Fed Policy, Is Fueling Market Gains

Asia Morning Briefing – 16/10/2025: QCP Points to Global Liquidity as Market Engine

According to QCP Capital, global markets are increasingly driven by liquidity rather than interest rate expectations. Central bank balance sheets, cross-border capital flows, and institutional hedging now influence market risk more than the Fed’s next 25 basis points.

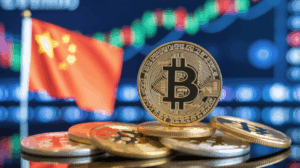

“Central bank purchases, de-dollarization flows, and institutional portfolio hedging have become the dominant forces supporting gold, extending its role beyond a traditional inflation hedge,” the firm said. Over the past weekend, the Bitcoin–gold correlation climbed above 0.85, highlighting coordinated capital movements between the two assets.

Prediction markets are signaling a gradual Fed easing cycle, favoring gold and digital assets over high-beta risk. On Kalshi, traders place a 76% probability on three rate cuts in 2025, totaling 75 basis points, consistent with JP Morgan’s “mid-cycle, non-recessionary” scenario. Fed Governor Michelle Bowman reinforced this outlook with comments supporting two additional cuts by year-end.

Bitcoin is trading within this liquidity-focused environment. Kalshi markets assign a 51% probability of BTC reaching $130,000 in 2025, 33% for $140,000, and 21% for $150,000, with even odds of hitting $150,000 by mid-2026. Market positioning suggests a slow, liquidity-fueled rally rather than a rapid speculative surge. Glassnode data shows a cluster of call options at $130,000, which may amplify short-term volatility while anchoring resistance near that level.

Macro and on-chain data indicate a steady, liquidity-driven advance, rather than a high-adrenaline bull run, though unexpected news could still sway markets in the short term.

Market Overview

- BTC: Trading above $110,500, down 2%, pressured by U.S.–China trade tensions. A break below $110,000 support could lead to $96,500–$100,000.

- ETH: Around $3,900, down 4%, as investors reduce exposure amid macro uncertainty. Optimists see Ethereum eventually tracking gold’s performance.

- Gold: Near $4,141.81/oz, supported by safe-haven demand amid trade tensions and expectations of Fed rate cuts.

- Nikkei 225: Up 0.95%, following Wall Street gains driven by strong bank earnings.

Share this content: