Bitcoin’s decline deepened Thursday as the cryptocurrency slipped through the crucial $100,000 level, extending its drop to a low of $96,600 during early Asian hours. The move pushed BTC to its weakest point since May, reflecting a broader shift toward risk aversion following a sharp pullback in U.S. tech stocks and fading confidence among major allocators.

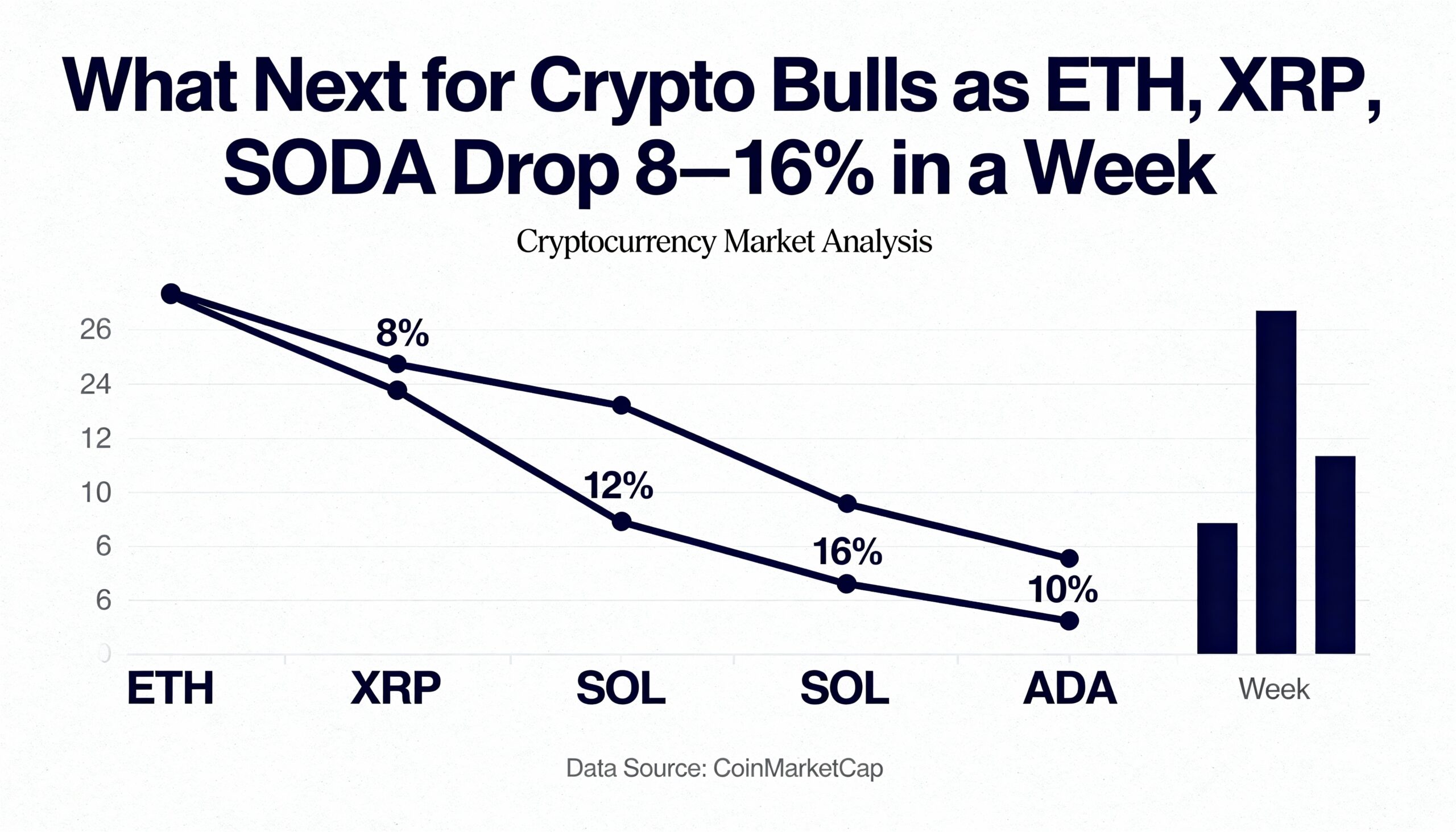

Losses were widespread across the crypto market. Ether fell to $3,182, marking a 12% weekly retreat, while XRP traded at $2.25 after dropping nearly 9% over the same period. BNB also slid, falling to $932 and shedding just under 8% on the week.

Several structural indicators are now pointing to a more entrenched downturn. ETF inflows have cooled for a second week, long-term holders continue to reduce exposure, and retail participation remains weak. Research firm 10x said these overlapping signals suggest the market has entered a clear bearish phase, with key pillars of support—ETF issuance, fund flows and corporate demand—no longer cushioning declines.

On the technical front, bitcoin’s break below the monthly mid-range of $100,266 has opened a notable liquidity pocket, creating room for a faster descent into thinner trading zones. Analysts now view $93,000 to $95,000 as the next significant support range. A failure to hold that band could expose BTC to a move toward the $89,600 liquidity gap, according to derivatives platform Bitunix.

Any attempt at recovery is expected to run into resistance near $100,200, with a stronger supply zone sitting around $107,300—a level that has repeatedly capped upside attempts in recent sessions. Market liquidity remains constrained across major trading venues, offering little sign of stabilization.

Bitunix noted that a short-term base may still develop around $93,000, though the risk of an accelerated downturn remains if this zone gives way. Nick Ruck of LVRG Research added that bitcoin’s ability to steady near $92,000 may hinge on whether upcoming FOMC minutes lean dovish. Persistent ETF outflows, a developing death-cross formation and uncertainty tied to delayed economic data in the wake of the government shutdown continue to weigh on sentiment.

Bitcoin’s latest slide has reversed all of its 30% year-to-date gains. The downturn extends a steady unwind from the Oct. 6 peak at $126,251—a record driven by optimism surrounding the Trump administration’s pro-crypto stance. That optimism faded quickly after unexpected tariff remarks rattled global markets and triggered broad deleveraging across risk assets.

Over the weekend, bitcoin briefly fell below $93,700 before recovering to around $94,800 in early Monday trading.

Share this content: