The Federal Reserve will begin Treasury bill purchases later Friday, starting with $8.2 billion as part of its reserve management program, injecting new liquidity into U.S. money markets.

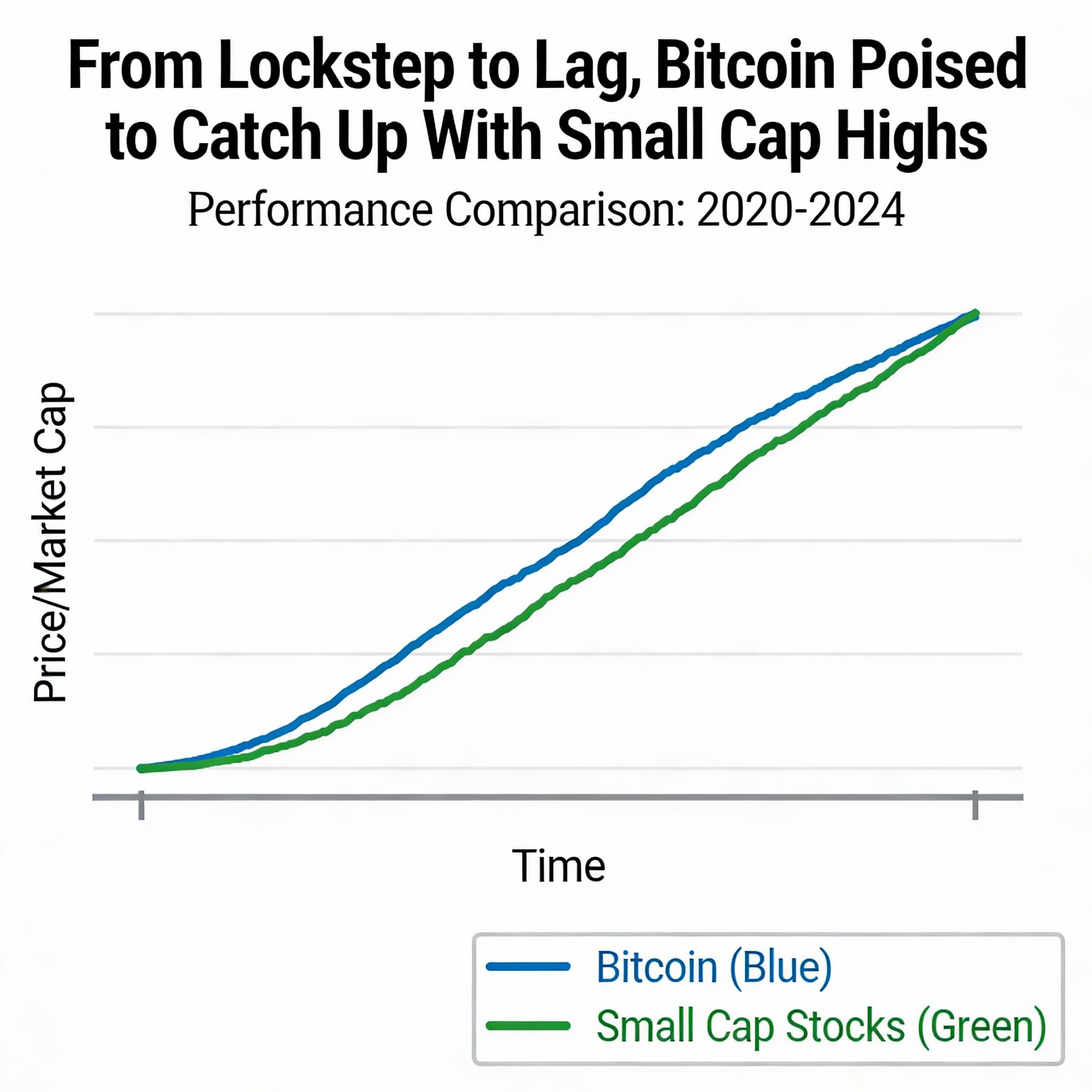

Small-Cap Rally Outpaces Bitcoin

For the first time in five years, the Russell 2000 Index (IWM) hit record highs, while Bitcoin (BTC $90,258) remains roughly 27% below its October peak, breaking its historical alignment with small-cap equities. Historically, Bitcoin rallies have tracked Russell 2000 highs—most recently in November 2021 at $69,000, early November 2024 above $90,000, and mid-October at $126,000. Both bottomed on Nov. 21.

Larger-cap benchmarks, including the Dow Jones Industrial Average and S&P 500, also reached record levels, with the Nasdaq 100 just below its all-time high. Precious metals, led by silver, are similarly hitting peaks.

Rate Cuts Fuel Risk Appetite

Smaller, more volatile companies are especially sensitive to interest-rate changes, a factor underscored by the Fed’s 25-basis-point cut on Wednesday. Goldman Sachs projects 2026 Russell 2000 earnings-per-share growth of roughly 49%. Markets are also pricing in an additional 50 basis points of rate cuts over the next 12 months, supporting risk assets, including cryptocurrencies.

Treasury Bill Purchases Begin

The Fed’s Treasury bill program launches Friday with $8.2 billion, part of a broader $40 billion plan starting Dec. 12, alongside reinvestments of maturing agency securities. This renewed liquidity is expected to strengthen money markets and support both equities and crypto.

With small-cap stocks surging and fresh monetary support in place, analysts suggest Bitcoin and other cryptocurrencies may soon catch up, narrowing the gap with record-setting U.S. equities.

Share this content: