Wall Street Debut of Figure Sees Split Opinions Between KBW and BofA

Figure Garners Mixed Reviews From Wall Street on Public Debut

Blockchain lender Figure (FIGR) is drawing praise for early leadership in tokenized credit markets, though analysts remain split on its ability to scale and navigate regulatory hurdles.

KBW Sees Strong Upside

Keefe, Bruyette & Woods (KBW) initiated coverage with an “outperform” rating and a $48.50 12-month price target, implying roughly 17.5% upside. The bank highlighted Figure’s market share—73% of private tokenized credit and 39% of all tokenized real-world assets—and noted that its technology could support additional credit products, including first-lien mortgages and personal loans, via Figure Exchange and third-party tokenization tools.

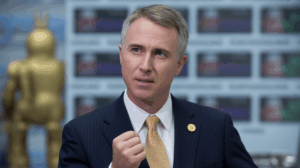

Founded by former SoFi CEO Mike Cagney, Figure went public in September, rising 12% since its IPO. Its core platform tokenizes HELOCs while integrating loan origination, distribution, and a digital asset marketplace.

Bernstein Also Bullish

Bernstein gave Figure an “outperform” rating with a $54 target, comparing the firm’s tokenization approach to stablecoins in payments, helping create faster and more efficient lending markets.

BofA More Cautious

Bank of America initiated coverage with a “neutral” rating and $41 target, citing execution risks, regulatory uncertainty, and dependence on HELOCs, which still account for most profits. BofA sees growth potential in Figure Connect, the company’s lender-capital matching marketplace, projected to drive 75% of revenue growth from 2024–2027.

Analyst Divergence Highlights Uncertainty

While all recognize Figure’s leadership in a niche market, the split between KBW’s $48.50 and BofA’s $41 targets underscores questions about the company’s ability to scale blockchain infrastructure beyond HELOCs and capture broader fintech opportunities.

Share this content: