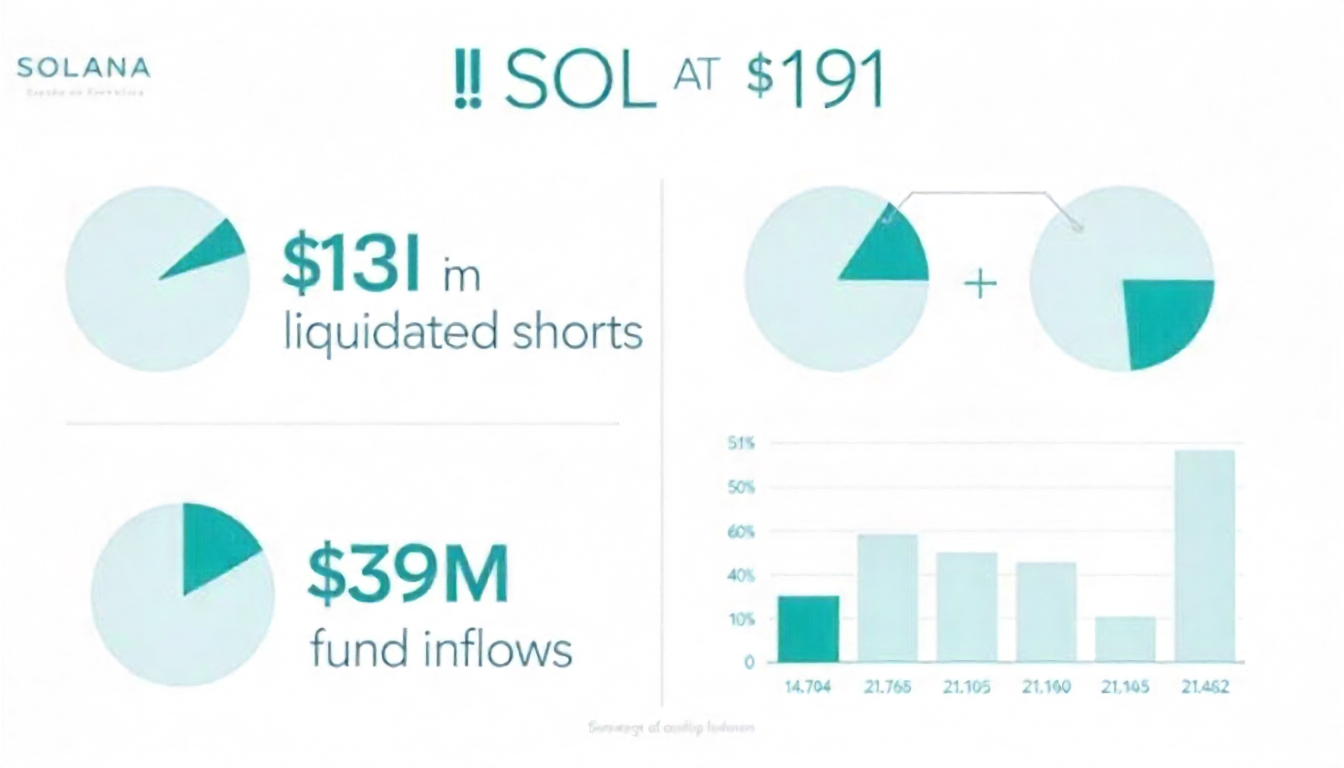

SOL Jumps to $191 as Bears Exit with $11M in Losses, Fund Inflows Reach $39M

Solana’s SOL Surges to $191 on $11M Short Squeeze and $39M Institutional Inflows

Solana’s SOL token climbed to $191.56 on Monday, extending its recent rally amid a wave of short liquidations and strong institutional interest. The token gained 6.55% over the past 24 hours, driven by on-chain activity and fresh fund inflows.

Analytics from SolanaFloor show that over $11 million in short positions were liquidated as SOL pushed past the $190 level. The largest single liquidation—$1.13 million—occurred at $188, highlighting how bearish traders were caught off guard by the sharp price move.

Institutional appetite is also rising. CoinShares’ latest Digital Asset Fund Flows report revealed $39 million flowed into Solana products for the week ending July 19, signaling growing confidence among professional investors.

Crypto analyst DonAlt noted on X that while he still favors Ethereum, Solana’s chart points to a potential breakout if it maintains momentum above current resistance levels.

Technical Summary:

- SOL rose 5.01% from $180.77 to $189.82 between July 20, 09:00 UTC, and July 21, 08:00 UTC (CoinDesk Research).

- The 24-hour trading range spanned $178.08 to $190.77, a 6.65% spread.

- Key support formed near $178.30, with volume spiking to 2.27 million at 22:00 UTC on July 20.

- SOL broke resistance at $183.20 early July 21, with volume holding above the daily average of 1.29 million.

- In the final hour, SOL climbed from $189.26 to $189.70, peaking at $190.77 before minor profit-taking.

With short sellers squeezed and institutional flows climbing, SOL looks poised to continue its upward trend if it holds above $190.

Share this content: