Schwab Prepares to Roll Out Crypto Trading, Setting Stage for Competition With Coinbase

Charles Schwab to Launch Crypto Trading, Targeting Coinbase’s Dominance in Retail Market

Charles Schwab is stepping deeper into the digital asset space, announcing plans to introduce direct trading for bitcoin (BTC) and ether (ETH) — a move that could reshape the competitive landscape for retail crypto investing.

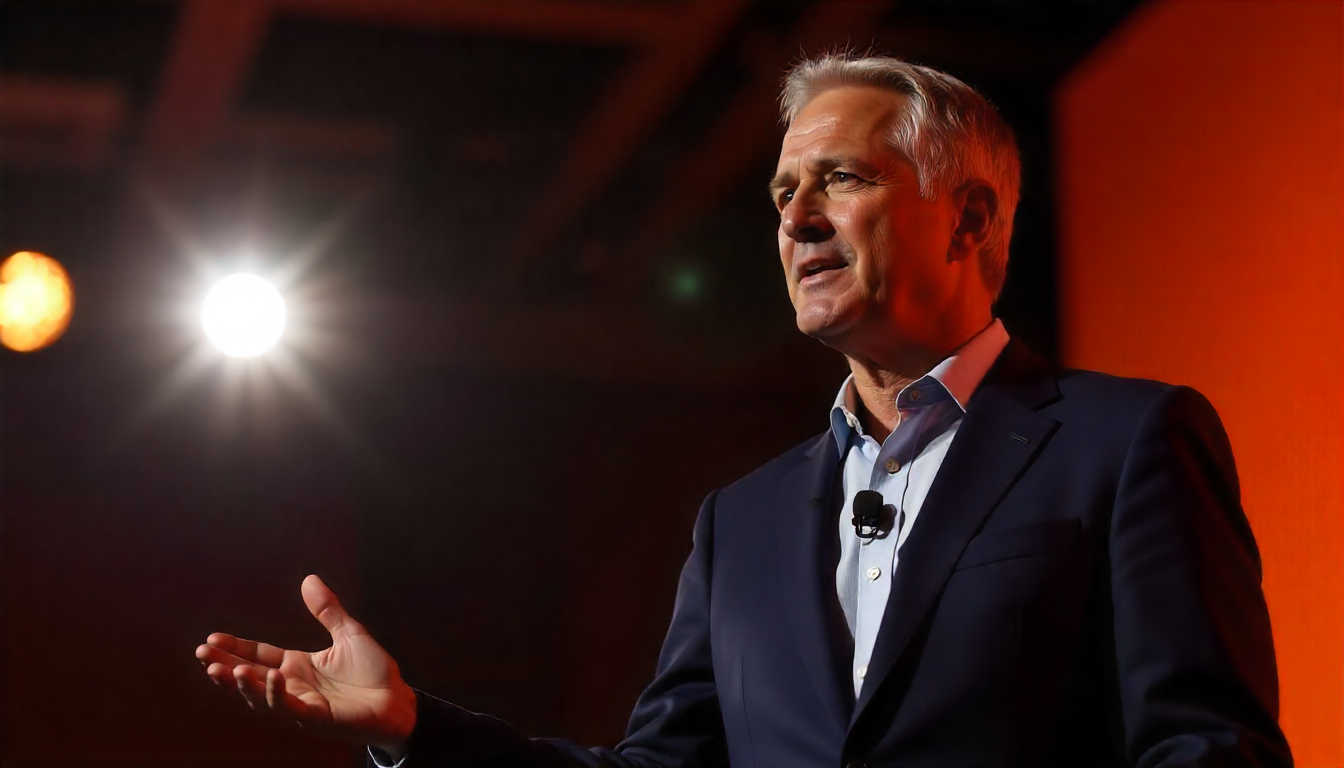

Speaking on CNBC’s Money Movers Friday, CEO Rick Wurster confirmed the upcoming rollout, positioning Schwab to challenge Coinbase by offering crypto services through its trusted, all-in-one financial platform.

“Clients don’t want fragmented accounts. They want crypto managed alongside their stocks and bonds,” said Wurster. Though crypto currently makes up a small portion of Schwab’s massive $10.8 trillion in client assets — with about $25 billion exposed — demand for integrated digital asset access is rising fast.

Until now, Schwab clients have largely accessed crypto through ETFs and other structured products. The firm holds over 20% of the total market share in crypto-linked ETPs. But with direct BTC and ETH trading on the horizon, Schwab is moving beyond passive exposure toward active retail engagement.

When asked whether the brokerage intends to compete with Coinbase, Wurster responded bluntly: “Absolutely.” Schwab sees an opportunity to serve investors seeking regulated custody, ease of use, and portfolio integration — all under one umbrella.

This strategic move comes as the U.S. prepares for a major regulatory breakthrough. President Trump is expected to sign the GENIUS Act into law, a landmark piece of legislation aimed at clarifying crypto rules and encouraging blockchain development. The regulatory clarity is expected to open doors for major financial institutions to expand digital asset offerings.

Although Schwab hasn’t announced a specific launch date for the trading service, its entry into crypto marks a significant shift — particularly for older and high-net-worth retail investors who’ve been hesitant to use crypto-native platforms.

Schwab’s stock reflected investor optimism, climbing 2.9% to close at $95.80 on Friday. Shares briefly touched $97.50, matching the company’s 52-week high. The firm now commands a market capitalization of $174.07 billion, with a P/E ratio of 28.47 and a 1.13% dividend yield, according to Google Finance.

Share this content: